Mom Budgeting: Realistic Money Habits That Actually Work for Busy Moms

Budgeting as a mom isn’t just about numbers—it’s about managing real life. Groceries change every week, kids constantly need something new, and unexpected expenses pop up without warning. The goal of mom budgeting isn’t perfection; it’s control, clarity, and peace of mind. With realistic systems and flexible habits, you can manage money without feeling restricted or overwhelmed.

Why Traditional Budgets Often Fail Moms

Many budgets are too strict and don’t account for the unpredictability of family life. Kids grow, needs change, and emotional spending happens when exhaustion hits. A mom-friendly budget works with your life, not against it. Flexibility is what makes a budget sustainable.

Start With Awareness, Not Restriction

Before cutting expenses, track where your money actually goes for one week. Groceries, snacks, kids’ items, small online purchases, and convenience spending often add up quietly. Awareness alone often leads to better choices without forcing yourself to “cut everything.”

Create Spending Categories That Reflect Real Life

Instead of generic categories, use ones that match your daily routine. Examples include groceries, kids’ needs, household items, personal care, and convenience spending. When categories feel realistic, you’re more likely to stick to them and adjust as needed instead of giving up.

Use Weekly Check-Ins Instead of Monthly Stress

Waiting until the end of the month to review spending can feel overwhelming. A short weekly check-in helps you adjust before things get out of control. It’s easier to course-correct early than to feel defeated later.

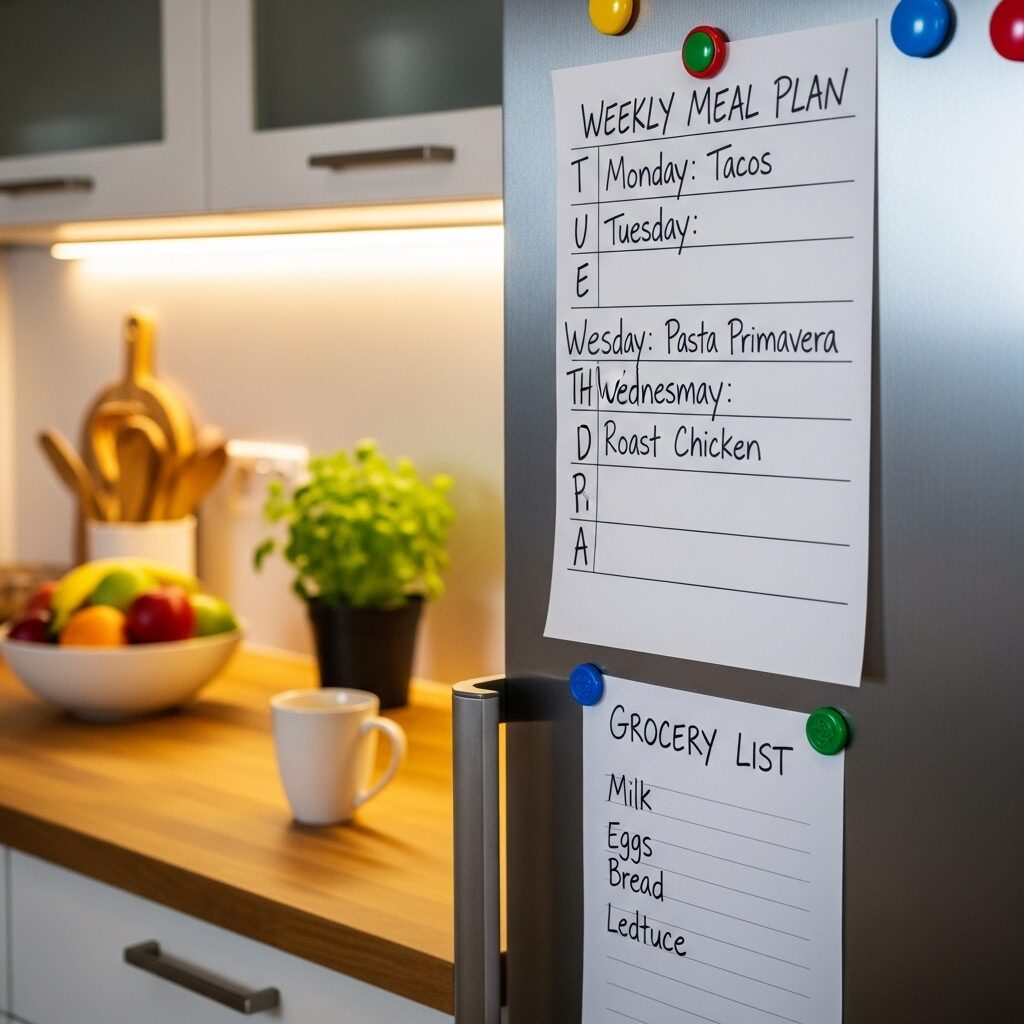

Meal Planning Is a Budgeting Superpower

Food is often the biggest variable expense for moms. Planning meals around what you already have and repeating simple meals reduces grocery bills and last-minute takeout. You don’t need fancy plans—just 5–7 repeat meals your family eats consistently.

Plan for Kid Expenses Instead of Being Surprised

Kids’ expenses aren’t random—they’re predictable. Clothes, school needs, activities, birthdays, and outings happen regularly. Setting aside a small monthly amount specifically for kids prevents stress and guilt when these expenses come up.

Limit Impulse Spending Without Feeling Deprived

Impulse spending often comes from exhaustion, boredom, or emotional overload. Instead of banning it, create a small personal spending buffer. Knowing you can spend a little removes the urge to overspend later.

Reduce Mental Load With Automation

Automating bills, savings, and recurring payments removes decision fatigue. When money moves automatically, you stay consistent without constantly thinking about it. Even small automated savings add up over time and build confidence.

Use a “Pause Before Purchase” Habit

Before buying anything non-essential, pause and ask yourself if it solves a real problem or just offers temporary relief. This simple habit dramatically reduces regret spending while still allowing intentional purchases.

Build a Small Emergency Buffer

An emergency fund doesn’t need to be big to be powerful. Even a small buffer helps cover surprise expenses like medical visits, school fees, or car repairs without panic. Progress matters more than the amount.

Teach Kids Budget Awareness Naturally

Kids don’t need lectures about money—they learn by watching. Involving them in simple decisions like choosing between two items or helping plan meals builds financial awareness without pressure.

Give Yourself Grace

Some months will go perfectly. Others won’t. A good mom budget allows flexibility without shame. Progress is measured in consistency, not perfection. The goal is a system that supports your family and your mental health.

Budgeting as a mom is about creating stability, reducing stress, and giving yourself permission to manage money in a way that fits your life—not someone else’s rules.