Mom Budgeting: Simple Ways to Manage Family Finances Without Stress

Managing money as a mom often means balancing household needs, children’s expenses, and long-term goals—all while trying to stay calm and organized. Mom budgeting isn’t about restriction or perfection. It’s about creating realistic systems that support your family and reduce financial stress.

Start With What You Actually Spend

Before creating a budget, track your current spending. Understanding where money goes helps you make informed decisions without guilt.

Create a Budget That Fits Your Lifestyle

Budgets should reflect real life, not ideal situations. Choose categories that match your family’s habits, priorities, and income.

Plan for Irregular Expenses

School supplies, birthdays, and holidays can disrupt budgets if they aren’t planned for. Setting aside small amounts regularly prevents financial surprises.

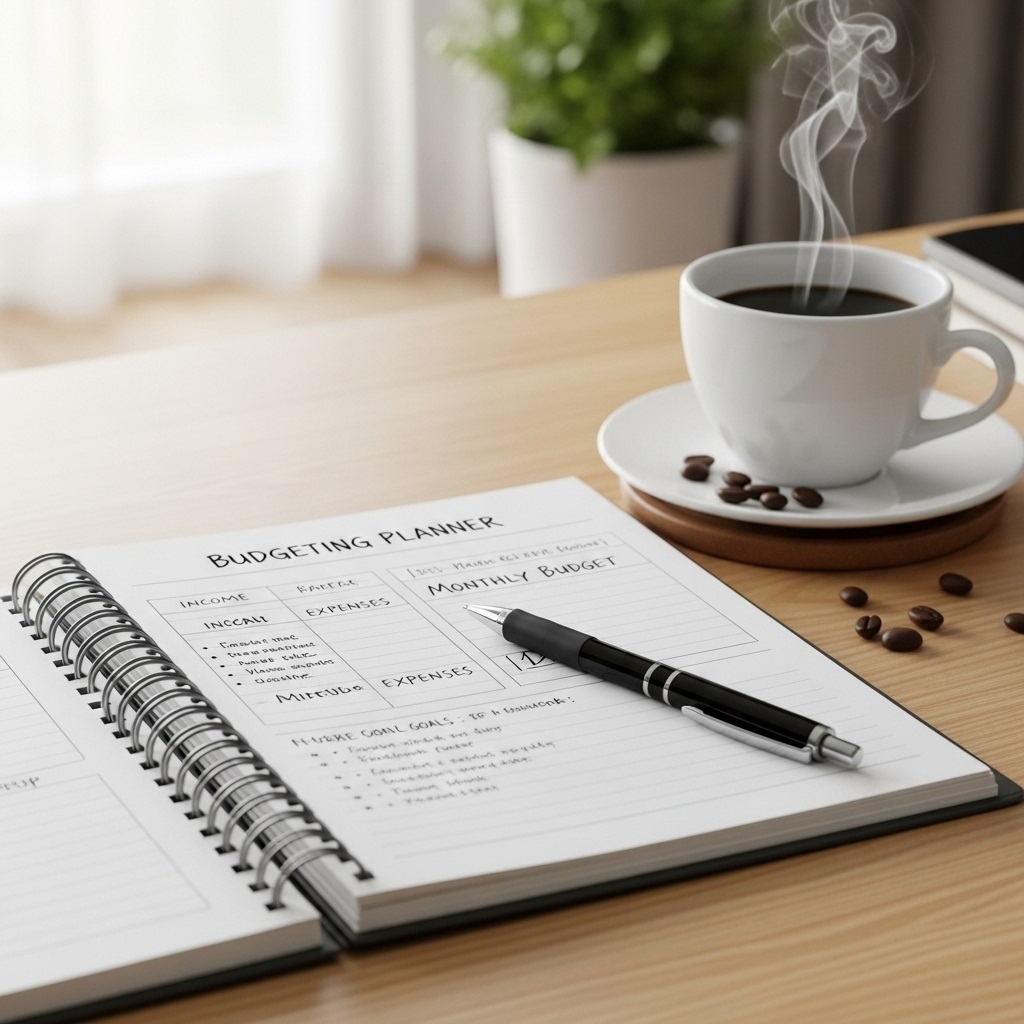

Use Simple Budgeting Tools

Spreadsheets, budgeting apps, or even paper planners work well. The best tool is the one you’ll actually use consistently.

Involve the Family When Possible

Age-appropriate money conversations teach children responsibility. Sharing basic budgeting concepts helps everyone understand financial goals.

Prioritize Needs Over Wants Without Guilt

Focusing on necessities first creates financial stability. Saying no to unnecessary spending now supports long-term security.

Build a Small Emergency Fund

Even a small savings buffer can reduce stress during unexpected situations. Start with achievable goals rather than aiming too high.

Meal Planning to Save Money

Planning meals reduces impulse spending and food waste. Cooking at home more often supports both health and budget goals.

Review Subscriptions Regularly

Monthly subscriptions add up quickly. Reviewing and canceling unused services can free up money with little effort.

Shop With Intention

Creating shopping lists and sticking to them helps avoid impulse purchases. Waiting before buying non-essentials can prevent regret.

Celebrate Small Financial Wins

Paying off debt, saving consistently, or staying within budget deserves recognition. Small wins build confidence and motivation.

Adjust as Life Changes

Budgets should evolve as your family grows. Revisit and adjust regularly to stay aligned with current needs.

Image Prompt: mom updating budget notes with a relaxed mindset.

Mom budgeting works best when it’s flexible and realistic. With simple habits and clear priorities, managing family finances becomes more empowering and less overwhelming.