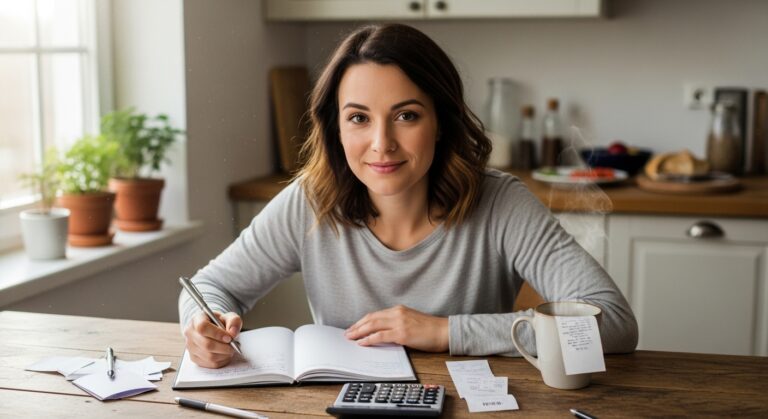

Mom Budgeting: Simple Money Habits That Help Families Save Without Stress

Managing money as a mom often means balancing family needs, daily expenses, and long-term goals—all while staying within a limited budget. Mom budgeting isn’t about strict rules or giving up everything you enjoy. It’s about creating simple systems that reduce financial stress and help your family feel more secure.

Start With a Clear Picture of Your Monthly Spending

Understanding where your money goes is the first step toward better budgeting. List all regular expenses, including groceries, utilities, childcare, and subscriptions. Seeing everything clearly helps identify areas where small changes can make a big difference.

Create a Flexible Family Budget

A budget should support your life, not restrict it. Leave room for unexpected expenses and adjust categories as needed. Flexibility prevents burnout and makes budgeting sustainable long term.

Plan Weekly Meals to Control Grocery Costs

Meal planning reduces food waste and prevents impulse purchases. Planning meals around sales and what you already have saves both time and money.

Track Spending Without Obsessing

Simple tracking—whether through a notebook or an app—keeps spending in check. The goal isn’t perfection but awareness. Checking in weekly is often enough to stay on track.

Set Realistic Savings Goals

Saving doesn’t need to be overwhelming. Start small, even if it’s just a little each month. Emergency funds, holiday savings, or school expenses become easier to manage with consistent contributions.

Reduce Costs With Small Daily Changes

Cutting expenses doesn’t always mean big sacrifices. Using store brands, limiting takeout, and canceling unused subscriptions can free up money without impacting your quality of life.

Involve the Family in Budgeting Habits

Teaching kids about money through everyday choices builds responsibility. Simple conversations about saving, spending, and priorities help children understand financial boundaries.

Use Cash or Separate Accounts for Control

Some moms find it helpful to use cash or separate accounts for categories like groceries or personal spending. This creates natural limits and reduces overspending.

Prepare for Irregular Expenses in Advance

School supplies, birthdays, and holidays can strain budgets if not planned for. Setting aside small amounts monthly prevents last-minute financial stress.

Avoid Comparing Your Budget to Others

Every family’s financial situation is different. Comparing spending habits or lifestyles creates unnecessary pressure. Focus on what works best for your family’s needs and goals.

Review and Adjust Regularly

Life changes, and budgets should change too. Reviewing your budget monthly helps you stay aligned with current expenses and priorities.

Give Yourself Grace

Budgeting is a learning process. Mistakes happen, and that’s okay. Progress matters more than perfection.

Mom budgeting is about creating peace, not pressure. With simple habits and realistic goals, managing money can feel empowering instead of overwhelming.